CapSeriesX — Scale Your Real Estate Empire Without Owning It All

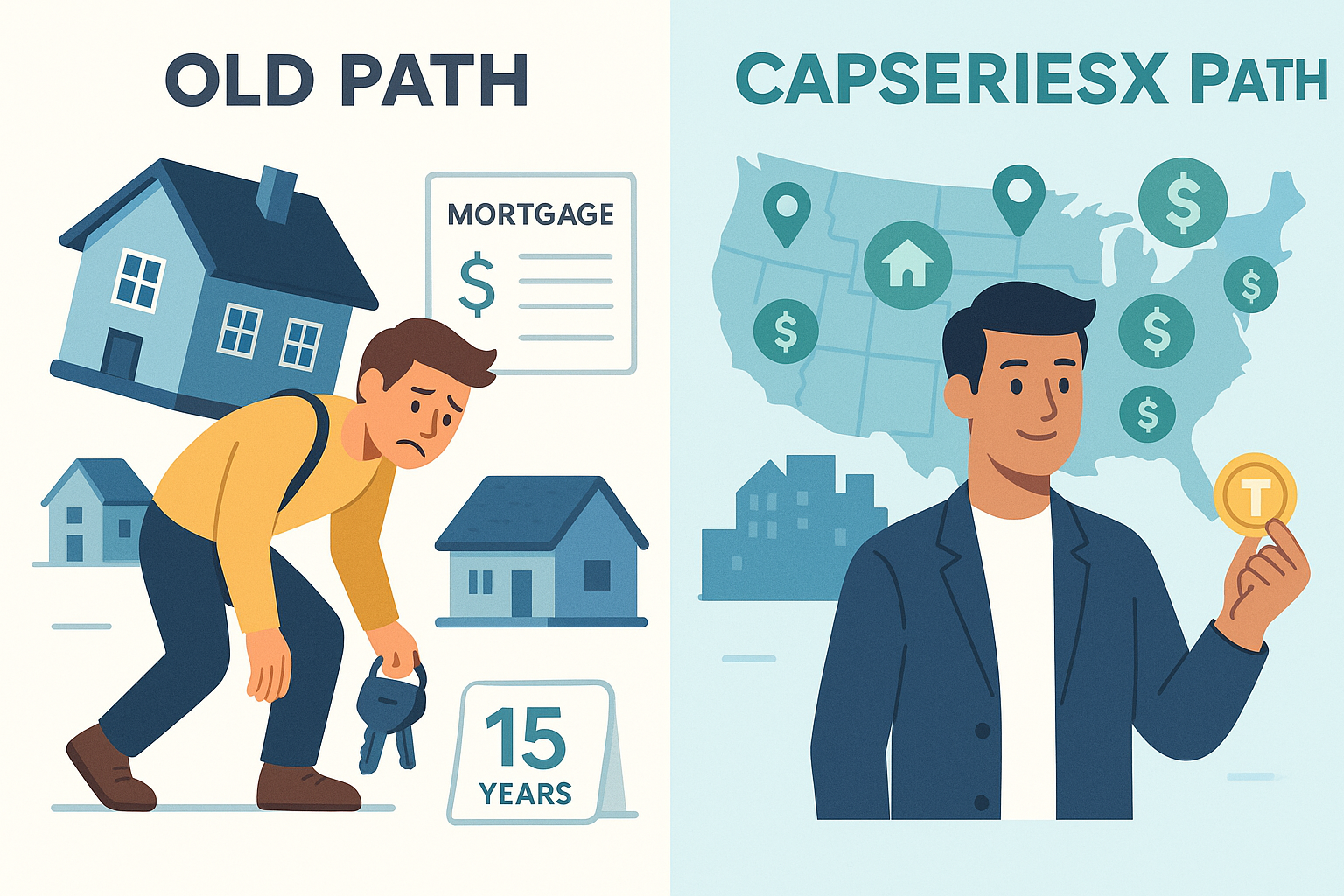

The Old Way Isn’t Working Anymore

- You work hard. Save up. Buy 1 rental.

- Take a mortgage. Hope rent covers it.

- Wait 15–20 years to build equity.

This model doesn’t scale. It carries liability, debt, and limited returns.

Turn Your Capital Into a Scalable Real Estate Business

- Raise funds legally through Series LLCs.

- Co-own property with 1–5% of your own capital.

- Earn recurring revenue from management fees.

- Build a branded portfolio across multiple states.

- Exit anytime with tokenized investor access.

With CapSeriesX, you’re not just an investor — you’re building your real estate firm.

Comparison Table

| Old Path | CapSeriesX Path |

|---|---|

| 100% + mortgage | 1–5% + capital raise |

| High personal liability | Limited liability per Series |

| 1–2 properties max | 100+ properties possible |

| Just rent | Rent + Management Fees + Equity |

| Sell after 15 yrs | Tokenize + fractional sell anytime |

CapSeriesX is built for:

- ✔️ Tech professionals with 15+ yrs of experience.

- ✔️ High-income earners looking for scalable wealth.

- ✔️ Community leaders ready to launch real estate clubs.

- ✔️ Anyone tired of the old landlord grind.

How It Works

3 Simple Steps to Launch:

- We form the Series LLC for your project

- You invite investors (or we help)

- We tokenize + manage legal + backend compliance

- You earn from your own real estate business

✅ Use your brand

✅ We handle legal + technology

✅ Raise money legally without being a broker

💬 Testimonials

“I thought I could only own 2 rentals in my life. Now I co-manage 20+.” – Rahul P., Senior Engineer, Texas

“The best way to turn real estate into a business, not a liability.” – Anjali R., Tech Leader, California

📢 FAQ

Q: Do I need a real estate license?

No. CapSeriesX handles legal, you manage the business.

Q: Can I use this with my community or investor group?

Yes! You can build your own real estate investment club under your brand.

Q: How do I raise funds legally?

We guide you with Reg D/Reg S compliance, investor onboarding, and tokenization.

Ready to stop owning and start managing?

Raise capital.

Build your portfolio.

Earn like an institution.